how are rsus taxed at ipo

This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. That income is subject to mandatory supplemental wage withholding.

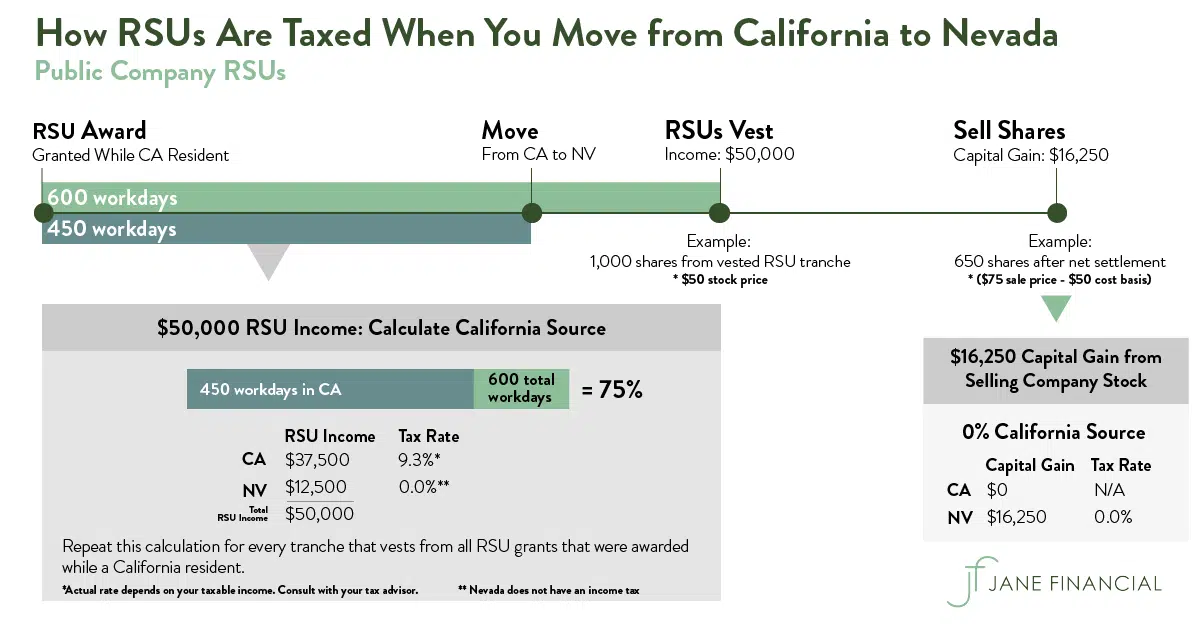

Restricted Stock Units Jane Financial

Those RSU shares are taxed as ordinary income and reported in the employees pay stub and on Form W-2.

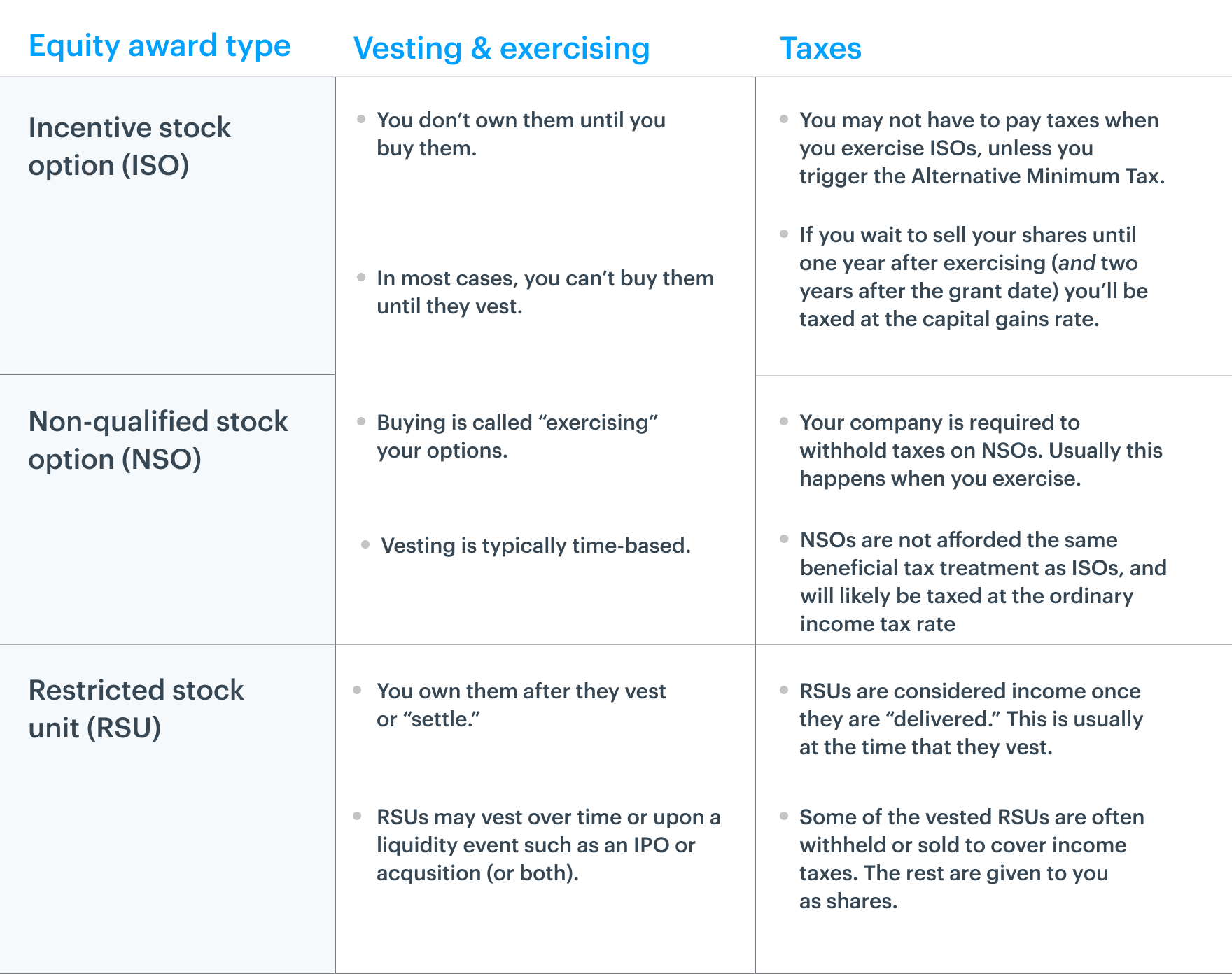

. The first is the tax shrink that you will experience from the number of shares you are promised to the number of shares that you get. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Watch out for RSUs.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Are they double trigger vestliquidity event 83i or do employees have to pay taxes in cash as soon as they vest. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

But RSUs at private companies pose a problem that doesnt exist at public companies. Once they vest they get taxed and they are in your possession. If RSUs vest while youre at a private company they usually wont be taxed until your company goes public.

Your company should withhold a portion of your RSUs at the time of IPO which will help cover a part of or all of your taxes owed. You cannot take ownership of double-trigger RSUs until both specified events happen. So if you had 10000 RSUs youd actually receive only 7800.

RSUs at private companies usually have a vesting schedule that has a double trigger. For estimating future taxes. Hiring a CPA So it is nice that companies offer you that choice for the RSUs vesting on IPO Day.

The first trigger is time like most security vesting schedules while the second trigger is an IPO. In examples like Airbnb Doordash etc. If your company grants you RSUs the total amount vested at the time of IPO is classified as supplemental income and is taxed at the regular income tax bracket rate.

When shares are sold the difference in value is treated as capital gain or loss. Sometimes 37 the highest income tax rate can be very handy and 22 is too low. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers.

IPO Pitfall 1 - Taxes Withholding Preferences If a company is already public RSUs are usually taxable when they vest. Restricted Stock Units RSUs Jan 1. Double-trigger RSUs are usually taxed after they vest usually on a time-based vesting schedule and the company experiences a liquidity-based event such as an acquisition or IPO.

How Are Restricted Stock Units RSUs Taxed. RSU compensation is taxed as ordinary income when the shares vest and based on your shares value on the vesting date. All your vested RSUs will be granted on the day of IPO so you will have only 1 vesting event.

But Im pretty sure I havent been taxes on RSUs Ive received from a pre-IPO company so I suspect its not always when the shares are delivered. A typical vesting schedule is where 25 of the shares vest per year over four years. And sometimes wont become taxable until after lock-up like in Rivians case.

How are RSUs taxed. FICA taxes and all. Here is an article on employee stock options.

Think of them like a cash bonus thats linked to the price of your companys stock. With RSUs there are no decisions to be made except for when you sell them. Your RSUs vest and become taxable 180 days after Event 2.

As such employers withhold taxes at the time of transfer. You are granted some RSUs. For estimating taxes for IPOs.

Typically employees need to pay attention to three specific ways that an IPO can impact their taxes. Input all the shares vested and the IPO price in the boxes below. Your taxable income is the market value of the shares at vesting.

RSUs or Restricted Stock Units trigger ordinary income tax when they vest and many RSUs have a vesting schedule thats reliant on an IPO. With double-trigger RSUs you will face compensation income when all the vested shares are delivered in one batch at the specified time after the second trigger and then also the FICA taxes when. RSUs can be frustrating for a couple of reasons.

You can also use this calculator to estimate your total taxes for the year. This means that your RSUs will vest or be considered income after an IPO. The fair market value of RSUs is taxable as ordinary income on the date that shares are actually transferred to the employee.

Which means that once your company is public youll need to stay on top of your tax bill throughout the year because youll need to pay additional taxes on RSU income. RSUs or Restricted Stock Units trigger ordinary income tax when they vest and many RSUs have a vesting schedule thats reliant on an IPO. At public companies the vesting schedule for RSUs is usually only single trigger.

RSUs are included in wage income. Double-trigger RSUs arent taxable until two specific events occur. An employee is taxed on the market value of vested RSU shares when the shares are delivered.

Yet all the RSUs are released fully on that day and you owe taxes. Your company has its IPO. At newly public companies grants made before the initial public offering IPO may also require a liquidity event ie the IPO itself to occur before the shares vest.

However you will need to input your best guess in terms of what the stock price will be at a. Now companies do usually withhold the statutory 22 tax rate usually by withholding shares from your total RSU grant. How do employees handle income taxes on pre-ipo vested rsus.

With RSUs you are taxed when the shares are delivered which is almost always at vesting. At this point youll have no tax consequences because you dont. When RSUs are granted to you shares dont become rightfully yours until you meet the vesting requirements and any other conditions.

You have compensation income subject to federal and employment tax Social Security and Medicare and any state and local tax.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

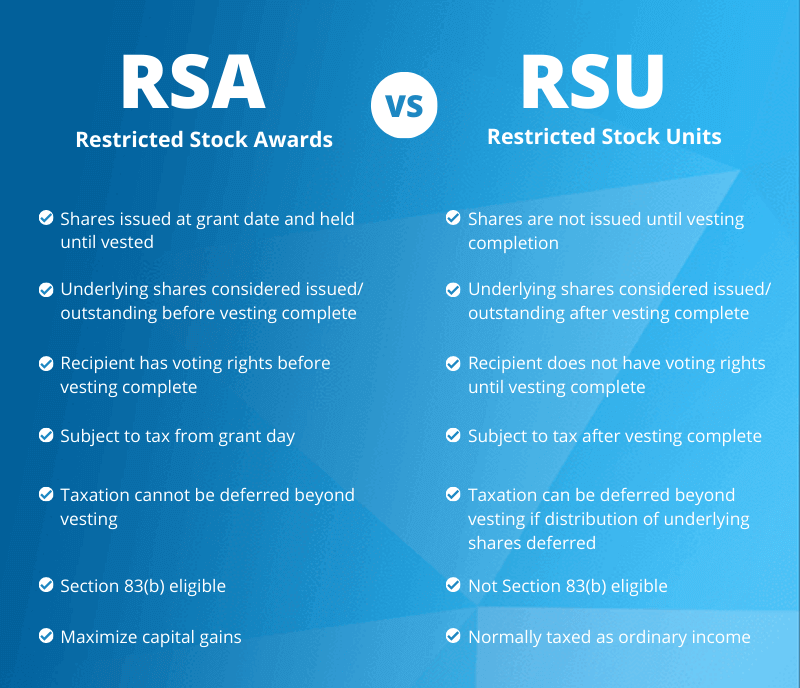

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Tax Planning For Stock Options

How Equity Holding Employees Can Prepare For An Ipo Carta

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Rsa Vs Rsu All You Need To Know Eqvista

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Restricted Stock Units Jane Financial

How Are Restricted Stock Awards And Restricted Stock Units Taxed